LAP offers individuals the opportunity to leverage their property to acquire large loan amounts at attractive interest rates compared to unsecured loans, thus unlocking the potential of their assets. Nandan Nilekani, co-founder of Infosys, in his report ‘The Great Unlock: India in 2035’, pointed to data showing that Indians hold nearly 50% of their assets in real estate, having the potential to unlock trillions in capital.

The housing market in India is expected to record a CAGR of 24.4% from 2024 to 2033 fuelled by urbanisation and rising incomes1 and by 2030, India will add about 75 million middle-class households2. Coupled with the above, the rise of alternative data points used in underwriting, such as digital payment histories and transaction patterns, has made it easier for individuals with limited formal credit histories to access LAP. There is a rising demand for secured business loans, particularly among small and medium-sized enterprises (SMEs) since access to traditional credit sources has often been a challenge for this segment, as they are typically not able to meet the stringent criteria1 and less than 15% of the 70 million odd MSMEs have access to formal credit in any manner as of March, 20213. Additionally, as MFIs face challenges like stricter regulations, loan defaults, and limited access to capital, borrowers in the low-income segment who previously relied on microloans may turn to more formal financial products like LAP.

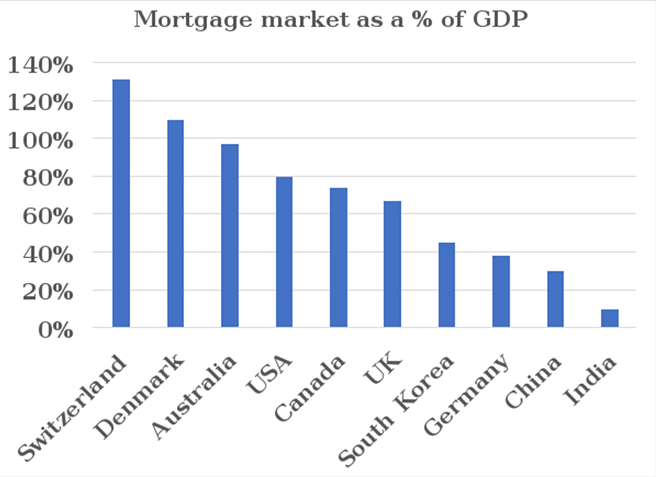

Mortgage market as a percentage of GDP for the following countries shows that penetration of mortgage market in India is significantly low compared to developed countries, thus presenting a huge scope for growth4.

Foreign Institutional Investors (FIIs) have been consistently positive about India for a range of structural, economic, and geopolitical reasons like high GDP growth, strong domestic demand, young population, expanding digital economy, stable governance, strategic global partnerships, etc. India is positioned as Asia-Pacific's second-largest PE-VC destination, capturing about 20 per cent of the total investment and reflecting growing investor confidence in the country's macroeconomic stability. Real estate and infrastructure led the pack at 16 per cent of total PE-VC and financial services saw a robust growth of about 25 per cent, driven by NBFCs5. Hence, the capital available for financial services companies, from both domestic and FIIs, is on the rise, further fuelling growth in the sector.

However, the LAP market comes with its share of challenges, particularly lack of awareness and financial literacy. A large segment of India’s population still lacks basic knowledge about personal finance, loan products, and credit ratings, which hampers their ability to make informed decisions about securing loans6. Without adequate awareness, borrowers tend to be reluctant to pledge their properties as collateral and as a result, prefer unsecured loans or other alternative financing options that are easier to access but come with higher interest rates or less favourable terms. Nevertheless, it is safe to say that financial literacy and financial inclusion in India are continuously improving due to initiatives like Pradhan Mantri Jan Dhan Yojana, financial literacy programs launched by the RBI, and technological advancements like Unified Payments Interface (UPI), to name a few. Because of the increase in awareness programs and deeper penetrations of secured LAP loans, the reluctance for LAP loans has been coming down and we should, over time, see overall improvement in the mortgage market as a percentage of GDP in India.

To sum up, LAP is not just another secured loan product—it is India’s bridge between dormant asset wealth and vibrant capital access. As financial systems digitize, data becomes more inclusive, and households seek affordable capital, LAP could become the go-to product for entrepreneurs, families, and professionals alike. Given India's massive real estate holdings, improving formal credit access, and FII-backed financial ecosystems, LAP is well-positioned to lead the credit market for the next decade.

GrowXCD aims to accelerate economic growth of MSMEs & low-income households through access to capital by building credit rails for institutional capital to flow seamlessly to retail assets backed by mortgage. While technology might be a roadblock for other players in this market, it is at the heart of everything we do at GrowXCD. For us, technology is an enabler and is strongly embedded in our core values. With a keen focus on the tech enabled LAP & small ticket mortgage loans as our flagship product, GrowXCD is well positioned to be one of the key players to support the 'The Great Unlock: India in 2035'.